Powering India’s Electric Trucks with Clean and Affordable Electricity

How renewable-powered charging could cut costs, reduce pollution, and scale zero-emission trucking in India.

India’s zero-emission trucking (ZET) market is on the brink of accelerated growth, reaching approximately 1,000 electric truck sales by the end of 2025. However, the supporting infrastructure has not kept pace: only about 5 percent of chargers in India can meet the power needs of zero-emission trucks, and high charging costs remain one of the most significant barriers to scaling the electric trucking market in India today. RMI analysis shows that electricity costs alone can account for 30–50 percent of an electric truck’s total cost of ownership (TCO) over 7 years.

As a result of high electricity prices, electric trucks remain 14–22 percent more expensive than diesel trucks without additional subsidies. Fleets and charging point operators (CPOs) are therefore actively exploring strategies to reduce charging costs. Among these, the use of renewables has emerged as a promising pathway, with the potential to both provide affordable charging and ensure that electric truck deployment delivers real climate and air quality benefits.

Today, only a small number of electric truck charging stations use renewables as part of their electricity supply mix. However, CPOs in India have begun to announce plans to deploy charging stations fully powered by renewables at scale, signaling market demand and growing readiness. This article breaks down the cost structure of charging, and explores how renewable-powered charging can reshape the charging economics.

What drives the electric truck charging price?

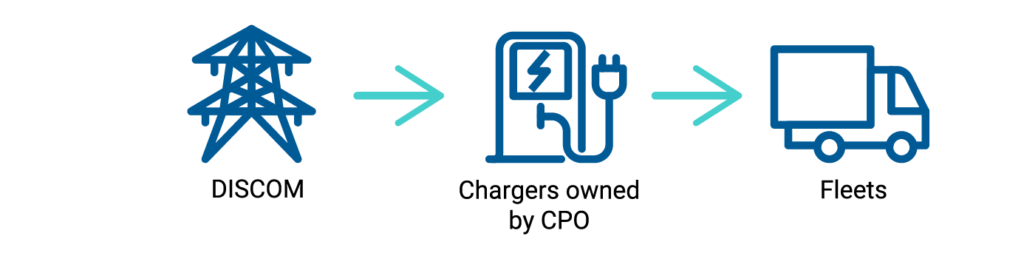

Currently, electric trucks in India are charged using grid-supplied electricity, which remains highly polluting given the country’s current generation mix. CPOs who own and operate charging stations set charging prices to recover their costs, including:

- Capital costs: The hardware cost of chargers, electrical infrastructure (e.g., switchgear), installation, and one-time interconnection fees paid to electricity distribution companies (DISCOMs).

- Operating costs: The highest operating costs are the EV tariff, which is the state-regulated price that CPOs pay to procure electricity from DISCOMs. It generally consists of two main components:

- Demand charge (Rs./kVA/month): A fixed monthly fee based on the maximum recorded power demand each month. Some states, such as Kerala, have waived this charge for EV tariffs.

- Energy charge (Rs./kWh): A variable cost based on the amount of electricity consumed. In 2024, the Ministry of Power issued guidelines suggesting that the energy charge should be 30 percent lower than the average cost of supply (ACoS) during solar hours (9am to 4pm) and 30 percent higher than the ACoS during non-solar hours. States such as Tamil Nadu, Kerala, and Jharkhand have implemented this adjustment to encourage EV charging during daylight hours when solar energy is abundant.

In addition, operating costs include recurring expenses such as operations and maintenance, labor, and land leases.

- Profit margin: CPOs usually add a profit margin on top of their capital and operating costs. In general, a CPO aims for a profit margin that delivers an internal rate of return (IRR) of about 15 percent over 15 years, which is typically considered reasonable for securing project financing.

- Goods and Services Tax: An 18 percent goods and services tax is included in the final electricity price.

India regulates charging prices through a service charge. This service charge covers all capital and operational expenses, excluding the EV tariff and land costs, and includes a profit margin. The Ministry of Power caps the service charge at INR11/kWh (US$0.12/kWh) during solar hours and INR13/kWh during non-solar hours to encourage affordable charging prices.

High electricity price is one of the key drivers for the high TCO of electric trucks. Reducing charging costs is therefore critical, and industry stakeholders are increasingly looking to renewable-based charging as a key solution.

Renewable-based charging options

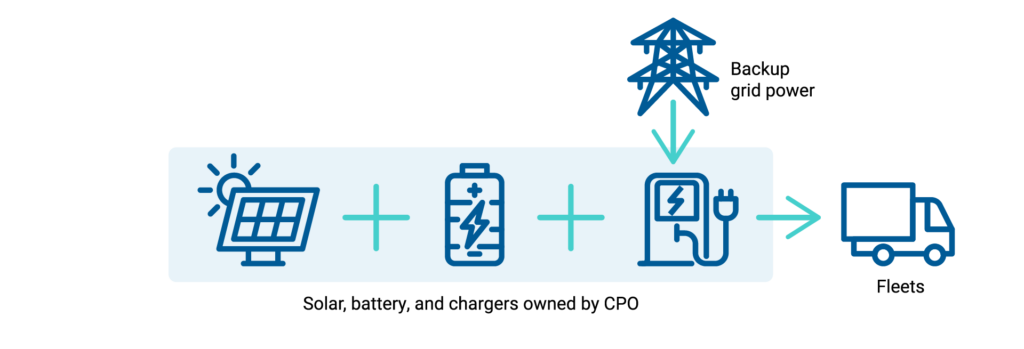

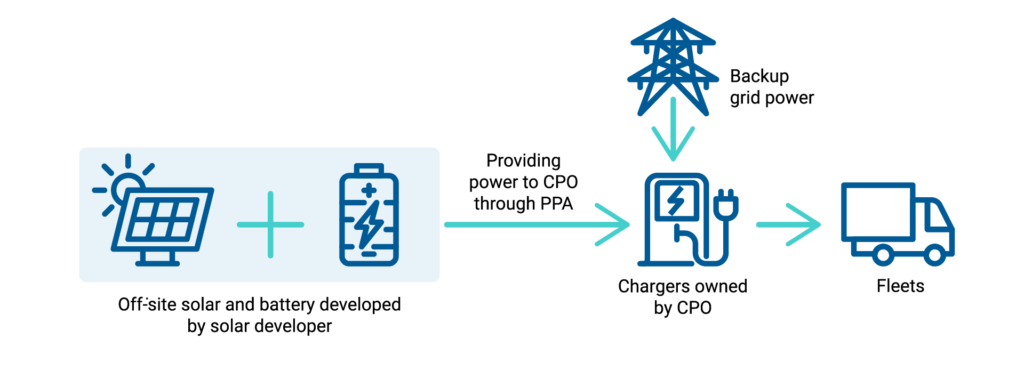

Several options are available for CPOs to establish renewable-based charging for electric trucks, as summarized in the table below.

Exhibit 1

Other options also exist for industrial consumers to source clean electricity, although they may only apply to specific use cases within the logistics sector. For example, a third-party renewable energy developer can install and operate an on-site solar and battery system exclusively for a charging site, with the CPO purchasing electricity from the developer through a PPA. This model suits CPOs that do not want to take on high up-front capital costs. However, the overall cost of operating a solar-based charging station may be higher due to the involvement of a third party. Another option is the group captive model, in which several electricity consumers jointly develop a solar plant to meet their own energy needs. This approach suits stakeholders with available land and significant demand for solar energy, potentially beyond EV charging, such as ports.

Does renewable-based charging provide greater savings?

To evaluate the cost-saving potential of various renewable-based charging solutions, we compared charging costs and the 7-year TCO for electric trucks across three scenarios: managed charging with EV tariffs, open-access PPAs, and on-site solar generation. All scenarios depict a charging site that includes five fast chargers (240 kW) and five slow chargers (100 kW) serving a fleet of 20 trucks.

Exhibit 2 shows the 7-year TCO results of the four modeled scenarios. Overall, the results show that in the near term, open-access PPAs are the most cost-effective and scalable pathway to lower charging costs, while on-site solar makes sense in land-rich, smaller-load contexts.

Exhibit 2

Stakeholder interviews indicate that a 15 percent IRR over 15 years is the standard profit threshold for CPOs to maintain economic viability. Using this benchmark, managed charging lowers the average electricity price from INR13.9 per kWh to INR12.9 per kWh. This results in a modest 2 percent reduction in the 7-year TCO. Under the PPA arrangement, the average electricity price falls to INR11.4 per kWh, leading to a 6 percent reduction in TCO.

An on-site solar-and-battery system increases electricity prices by about 3 percent, largely due to the land required to install enough capacity to serve 20 trucks. While a fully renewable on-site supply can lower energy costs, high land requirements raise overall project costs. Smaller systems reduce land needs but rely more on grid power, increasing charging costs, making careful system sizing essential. In practice, the economics depend on land costs, land ownership, and local solar resources, and this arrangement is more cost-effective when serving fewer trucks and lower loads due to the lower land requirements.

Exhibit 3 summarizes the key implementation considerations of the three scenarios.

Exhibit 3

Renewable-based charging can offer a cost advantage, but its success depends on site-specific conditions. Key considerations include land availability, local solar potential, the ability to leverage time-of-use tariffs, and whether charging schedules can be aligned with periods of solar generation. Considering these practical factors can help translate renewable-powered charging from concept to deployable, cost-effective solutions.

The case for renewable-based charging

Beyond cost considerations, charging electric trucks with renewables offers several crucial benefits. It reduces stress on the grid, particularly as India experiences rapid growth in electricity demand across multiple sectors. Moreover, renewable-based charging delivers climate, environmental, and public health benefits, making zero-emission trucks truly clean.

Near-term deployment of renewable-powered charging pilots is essential to validate the technical and financial case for electric truck charging. These pilots should test the system designs and operating strategies outlined above and be led through public–private partnership models, where public engagement can play a catalytic role. To enable these projects, targeted public incentives, such as land rebates and fiscal support for public charging infrastructure and renewable generation, should be developed to support public–private partnerships. By generating real-world cost and performance data, early projects can inform policy, attract private investment, and enable the scale-up of a clean, affordable, and reliable electric truck charging network across India.

Methodology

This analysis assumes five fast chargers (240 kW) and five slow chargers (100 kW) serving a fleet of 20 trucks. These numbers were determined by assuming a benchmark utilization rate of 12 percent for fast charging, and 24 percent for slow charging in 2026.

The managed charging with EV tariff scenario models that 25 percent of the fleet exclusively charge at solar hours to lower the charging cost, while the remaining trucks charge once during solar hours and once during non-solar hours. This analysis is based on EV tariff rates in Kerala, because Kerala has one of the most comprehensive time-of-day EV charging rates across all states.

In the open-access PPA scenario, the CPO signs a 7-year PPA with an in-state solar developer for 1.7 MW of contracted solar capacity. This is the peak load when all five fast chargers (240 kW) and five slow chargers (100 kW) are used at the same time.

The on-site solar generation scenario assumes a 685 kW solar installation paired with a 1.2 MWh battery. The remaining energy demand is met through grid electricity. The analysis first assessed a configuration limited to the standard rooftop area available at a 10-charger site, approximately 2,000 m², requiring no additional land but would use a significant amount of energy from the grid. A fully solar-powered configuration was then evaluated, which would require roughly five times the area of a typical charging hub. Both configurations resulted in higher electricity costs. An intermediate solar system was identified as the cost-optimal option. Using NREL’s PVWatts Calculator, a 685 kW solar PV system was selected. The battery capacity was then sized based on the average daily energy generated by the 685 kW solar system. After deriving the optimal amount of renewable energy to use for electric truck charging during the day, the remaining surplus energy generated was modeled to be stored by the battery system, which informed the required storage size of approximately 1.2 MWh. The grid then meets any remaining energy demand from charging when needed.

The authors would like to thank Benny Bertagnini, Pranav Lakhina, Ramit Raunak, Shilpi Sharma, and Ishani Srivastava for their contributions to this piece.