How to Beat the Market in Climate Tech? Invest in Women.

In the world of venture capital (VC), all-male teams land 90 percent of funding globally. Among climate tech VCs, closing this gender gap could deliver $12 billion in additional annual returns. RMI's Third Derivative unpacks the origins of this gap — and how to close it.

The disruptive impact of climate change demands bold innovation — and equally bold, strategic investment. One proven way to unlock stronger returns and accelerate solutions? Fund more women-led startups in climate tech. The data supporting their success is clear and growing — but the capital still isn’t flowing at the scale it should be. This gap means that money and climate impact are being left on the table.

Female founders could be ‘moneyball’ for climate tech.

Fiona Howarth, CEO of Octopus EVs

In this article, we aim to shed light on:

- How much more money could be made if we successfully address gender disparities in climate tech.

- The disconnect between the proven potential of women-led climate tech teams and the persistently low investment levels they receive — and the reasons for this persistent gap.

- What we’ve gotten right at Third Derivative and, more importantly, how we need to improve — grounded in direct feedback from several of the women leading our portfolio companies.

A note on language: Gender identity is complex and nonbinary, but we mostly use the words “women” and “female” interchangeably in this article. This is simply because almost all the data we use and studies we reference use this language and categorization.

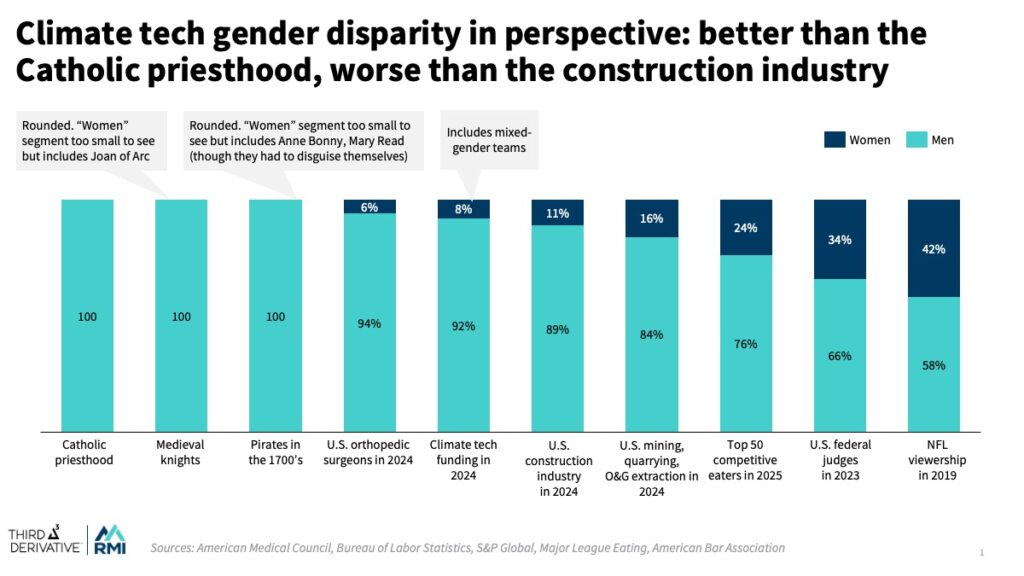

Quantifying the climate tech gender gap

Globally, female-only founders in climate tech captured just 5.3 percent of climate tech deals and 1.1 percent of total funding in the first nine months of 2024. Mixed-gender founding teams accounted for 21 percent of deals and 7 percent of capital raised. Similarly, in the United States, exclusively female-founded companies received just $136 million — only 0.4 percent of the $34 billion invested in climate tech startups — while mixed-gender founding teams secured $2.5 billion, or roughly 7.3 percent of total funding. This means that globally and in the United States, nearly over 90 percent of investment went to founding teams composed entirely of men.

These 2024 numbers are more skewed than the breakdown for venture capital (VC) investment across all sectors, with approximately 21 percent of VC dollars going to mixed-gender founding teams, 77 percent going to all-men founding teams, and 2 percent going to all-women founding teams in the United States.

However, this article isn’t about ethics, it’s about economics.

A $12 billion market opportunity

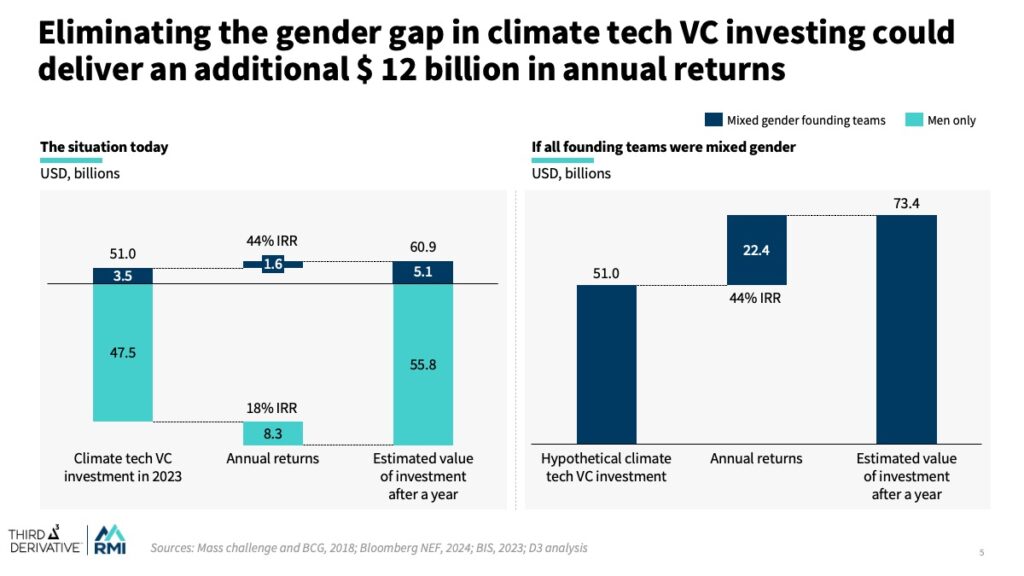

This gender disparity in climate tech leaves a lot of money on the table. Consistently investing in mixed-gender founding climate tech teams would create over $12 billion in additional annual returns.

This is based on a few assumptions and historical data. One, it assumes that the gender difference in VC investment performance found in 2018 persists today. Two, it assumes that the gender performance difference for VC in general applies to climate tech in particular. And three, it assumes average performance based on historical data and funding (internal rate of return [IRR] of ~19 percent from 2005 to 2021).

Even offering these disclaimers is a bit ironic, since women founders are generally better at offering disclaimers and avoiding the oversell — unfortunately to their detriment (more on this below).

Importantly, there is little evidence to suggest that the gap in investment performance has narrowed or that it differs significantly between climate tech and the broader VC investment landscape.

Male-only teams account for 90 percent of VC funding globally. Closing this gap in climate tech VC investing could deliver an additional $12 billion in annual returns. While $12 billion is good money, the climate impact is even better. Closing the gap would mean that critical early-stage solutions make faster progress to commercialization, eliminating more climate pollution, sooner. Assuming exits are a reasonable proxy for commercialization, that means a 13 percent reduction in the average time it takes to go from early prototype (technology readiness level 4) to commercial operation (technology readiness level 9).

What the data says: Gender diversity is good business

We invest in female founders because they consistently outperform — delivering higher returns, stronger capital efficiency, and deeper community impact. In Africa’s climate sector, women are not just underrepresented — they are underestimated. Backing them is not charity; it’s smart investing.

Lyndsay Holley Handler, Managing Partner of Delta40 and former CEO of Fenix International

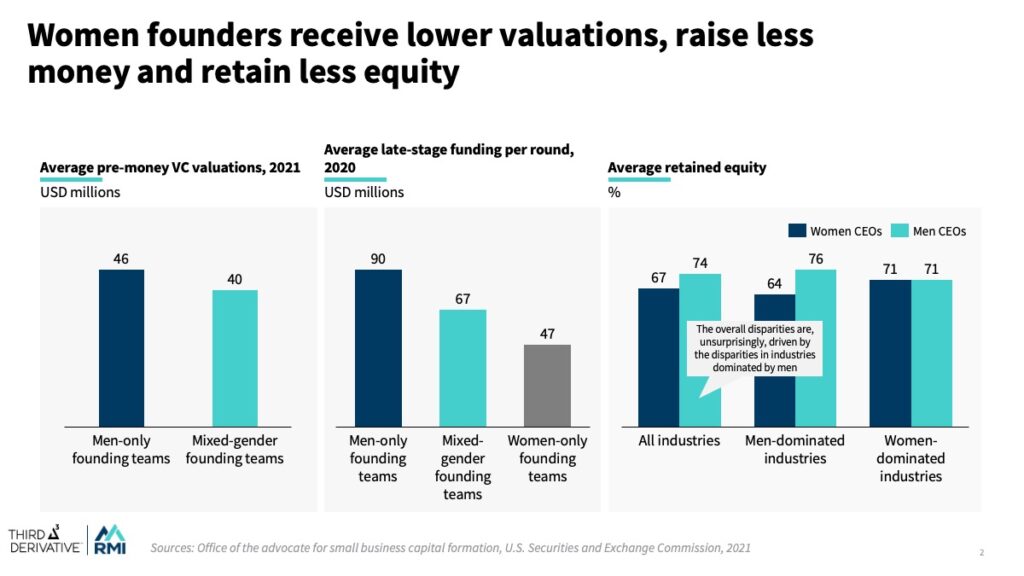

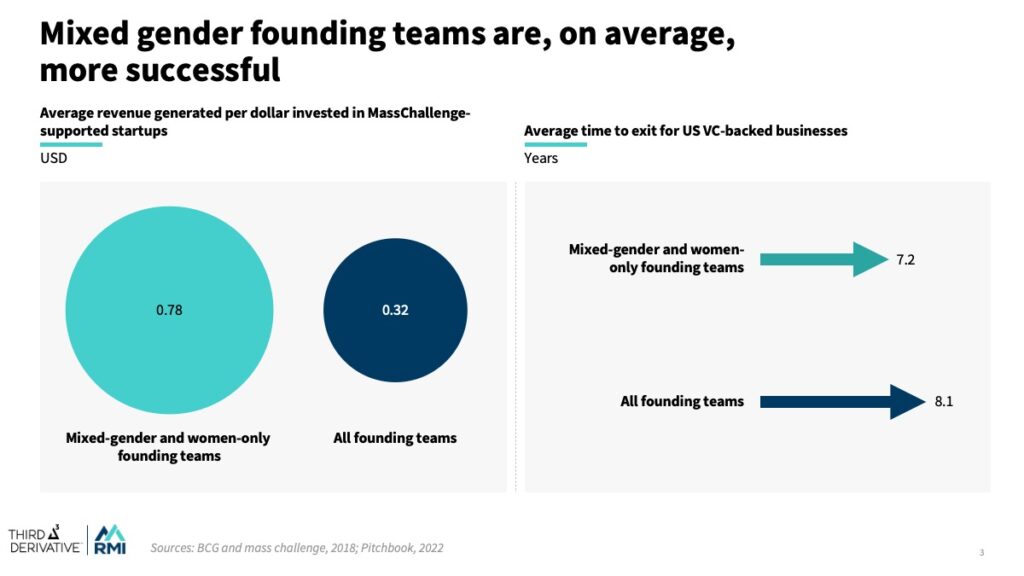

Our $12 billion conclusion is based on a rich body of evidence. A 2018 study from consulting firm BCG and MassChallenge (a network of accelerators) found that startups with female founders — including startups with mixed-gender founding teams — returned $0.78 in revenue for every dollar invested compared with $0.31 for startups with men-only founding teams. (Granted, revenue is not the same as returns, and different industries and products have different unit economics, but the study included a wide range of businesses and locations.)

Startups with at least one woman founder also deliver faster exits — 7.2 years versus the US average of 8.1 years. It’s worth noting that the latter figure includes women — which means that the performance difference is even bigger when comparing mixed-gender founding teams against men-only founding teams.

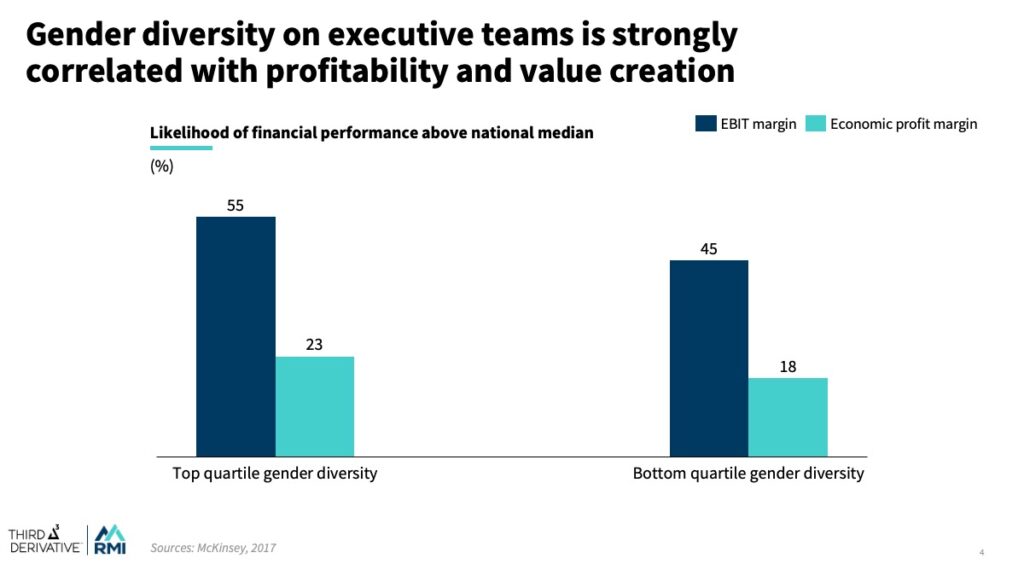

These advantages persist as companies mature. A 2017 survey of more than 1,000 mature companies across 12 countries found a strong correlation between executive gender diversity and financial performance; companies that were in the top quartile for gender diversity were 21 percent more likely to have above-median financial performance than companies in the lowest quartile for gender diversity.

None of this is new, considering the wealth of gender-related data already available on academic and workplace performance and strengths. That women-led startups do better is consistent with the data showing that females outperform males in academic success (across nearly all subjects and education levels, including enrollment and graduation rates), emotional intelligence, and leadership characteristics.

And still, even with the growing amount of publicly available evidence and references to women founder performance, the gap in climate tech persists.

It’s a no-brainer to boost support of women-led startups in climate and energy tech — 2050 is just around the corner. Women bring a different approach to risk and an understanding of context, which will open new avenues.

Capella Festa, President of Schlumberger Foundation

From insight to action — what’s missing?

With years of documented evidence showing the strong performance of women-led and gender-diverse teams, it’s natural to ask: why hasn’t this translated into more equitable investment? It’s a question we’ve been reflecting on ourselves.

Part of the answer lies in the deep-rooted norms and long-standing decision-making patterns that still shape much of the investment community. These habits are often reinforced by networks that remain relatively homogenous, informal deal flow processes that rely heavily on personal connections, and a tendency to default to “pattern recognition” that favors familiar profiles — usually male.

Both women and men may genuinely want to support female founders, but unconsciously, many of us are conditioned to perceive men as more natural “doers” or executors. As a result, I often find myself being tested by both women and men alike.

Aurélie Gonzalez, Founder and CEO of Yama

When it comes to the composition of venture capital firm teams, these dynamics also apply. Women make up only 19 percent of investing partners at VC firms in the United States, despite making up approximately 50 percent of the student body at top US business schools. Research shows that when VC firms increase their female partner hires by 10 percent, they see a 1.5 percent increase in annual fund returns and 10 percent more profitable exits.

And yet, even this kind of compelling data — like the stronger financial performance of diverse teams across startups and venture capital firms — can be ignored when it challenges ingrained instincts.

The data may also not be reaching the right people — or it may not be packaged in a way that resonates. Investment professionals are inundated with information, and unless insights are directly tied to their day-to-day decision-making, portfolio goals, or return metrics, they can easily be dismissed as peripheral or “nice to have.” Data that speaks to diversity without clearly demonstrating the associated economic opportunity may struggle to gain traction in traditional investment environments. Similarly, insights that aren’t broken down by sector, geography, or stage may be seen as too general to inform real decisions.

Relatedly, the data may lack the consistency or clarity needed to drive conviction at scale. How we collectively define terms like “founder” or “women-led” or even “climate tech” matters more than we often realize. These definitions shape who gets counted in the data. A narrow or inconsistent definition can exclude key contributors — such as co-founders who may not hold a C-level title.

On the other hand, when definitions are too broad or inconsistently applied, we risk overrepresenting progress in the data and painting a misleading picture of inclusion. It may suggest that the investment landscape is more equitable than it actually is, discouraging the very action and urgency needed to drive change. When data skews toward inclusion without precision, it can weaken the case for targeted support, dilute the impact of real progress, and make it harder to identify and address persistent structural barriers. For example, platforms like Pitchbook, Dealroom, and Crunchbase — commonly used as primary data sources in studies and publications on women founders — often report differing figures.

Another caveat is that most available data on founder diversity centers on deal counts and funding amounts, while comprehensive statistics on the total number of climate tech startups —and how many are led by women — are much harder to find.

An added shortcoming that we must recognize with available data: much of it is centered on the Global North. The majority of available research, metrics, and case studies are drawn from North America and Europe, where data is more readily collected and shared — but this paints an incomplete picture of the global innovation landscape.

Lastly, it’s hard to ignore the macro environment in which climate tech founders operate today. According to PitchBook, over the past two years, the majority of the largest US public alternative asset managers have removed diversity, equity, and inclusion (DEI) language and initiatives. Decisions like these, along with government actions aimed at curbing DEI, have a direct effect. This will likely further impact VC initiatives to increase investment in women climate tech founders, effectively narrowing entry points for underrepresented founders.

We at Third Derivative realize that simply surfacing data isn’t enough. Changing behavior requires not just awareness, but also trust, relevance, and actionable pathways. This realization is shaping how we approach our work — by not only sharing compelling evidence, but also tailoring insights for the audiences we’re trying to influence, listening to the feedback of founders directly, and being honest about where we, too, need to learn and evolve.

Working together to shift the system

A number of organizations have developed comprehensive sets of recommendations aimed at addressing gender disparities in venture capital writ large, including Harvard, Diversity VC, 2X Challenge, UBS, BCG, MassChallenge, and the World Economic Forum. Rather than attempt to recreate or synthesize them, we focus here on a subset of actions over which Third Derivative, RMI, and our ecosystem have the most agency.

Third Derivative is a global climate tech accelerator, research organization, and nonprofit investor, not a VC firm. Nevertheless, we hope some of these ideas — many sourced directly from our founders — are useful to both climate tech VCs and others in the space — venture studios, accelerators, professional services firms serving climate tech founders, and later-stage investors.

Most importantly, all actions highlighted below come from the same starting point: an honest accounting of where the sector is today and a willingness for ecosystem players to do something about it — even if that willingness is simply rooted in making more money. (As goes an RMI mantra: we care about outcomes, not motives.)

Attendees at Third Derivative’s co-hosted breakfast roundtable, Investing in Climate Tech: Spotlighting Female Innovators, at London Climate Action Week 2024. For each of the recommendations below, we’ve analyzed where Third Derivative has identified effective approaches we can confidently recommend to others; where we are actively developing new systems that show promise but are still evolving; and where we look for ideas, insights, and collaboration from our broader ecosystem.

Ensure gender balance on teams, paying particularly close attention to leadership, investment, and diligence functions

In many ways, Third Derivative is making meaningful progress toward the kind of team representation we want to see. Currently, 58 percent of our team identifies as female, with an additional 6 percent identifying as “unspecified.” Among those in leadership and management roles (principals and managers), that figure rises to 69 percent. However, when focusing solely on principal-level leadership, the gender balance shifts — four of six principals currently identify as male. As our managers continue to grow into senior roles, we’re committed to helping more women managers grow into principal roles.

We are working to ensure that opportunities for career development and progression are equally available to our early-career people, including through structured mentorship and coaching, individual development plans, and a transparent performance review process.

Organizations such as Diversity VC offer useful lessons in this. Their mission is “to equip every venture fund to have the understanding, tools, and resources to promote diversity and inclusion in both their firms and the companies they fund.” They have a wide array of publicly available resources, including a Diversity in VC Toolkit. We also look to connect and learn more from other VCs and accelerators that place high value on team diversity, such as Delta40, Lowercarbon Capital, the Los Angeles Cleantech Incubator (LACI), Powerhouse Ventures, Rethink Impact, and VentureSouq.

Building balanced teams is essential, but it’s equally important to recognize the pivotal role male allies play in advancing equity and driving meaningful change. A survey by All Raise of women and nonbinary individuals in venture capital found that 98 percent received critical support from men — whether through championing them for promotions, co-investing, or facilitating key introductions.

At Third Derivative, we believe that advocating for women founders and building a more inclusive ecosystem isn’t just the work of our female and nonbinary-identifying team members — it’s a shared responsibility across the entire team. All team members, regardless of gender, are encouraged — and expected — to actively contribute to this effort. That includes speaking up when they witness bias or discrimination, and using their platforms to elevate and support women and nonbinary team members and founders.

Ascribe value for gender diversity, maximize objectivity, and minimize bias in selection and diligence processes

Third Derivative attempts to minimize bias through a rigorous three-part selection process that strives for objectivity. Crucially, we try to ensure gender diversity in our own evaluation teams and try to stay aware of and eliminate affinity and other biases.

The process begins with an active sourcing push, led by our research and diligence (R&D) team, where diverse teams are encouraged to apply. This is complemented by an open call for applications. Admittedly, there is still room for us to improve by taking more strategic and concerted efforts to recruit women-led startup applicants — something we commit to designing and executing as part of our upcoming fiscal year strategy, calling upon our ecosystem for support.

Applicant evaluations are conducted using a standardized methodology to quantify climate change mitigation potential, complemented by qualitative assessments of impacts on Earth system boundaries, climate adaptation, environmental justice, and public health. Individual assessments by the R&D team are followed by group discussions to minimize bias from seniority or influence. Insights are also drawn from RMI’s extensive expert network and a broad range of industry and academic partners to enhance objectivity and diversity. In the final stage, selected founders present to our corporate and investor partners in structured pitch sessions, with partner feedback helping inform the final, collaboratively debated selection. The final selection committee and broader debate group are gender diverse. While it’s not feasible for all applicants, we also strive to offer actionable feedback to those reaching the final stage.

The result is that the Third Derivative portfolio, while still having areas to improve, looks better than average; 34 percent of our portfolio companies have at least one female founder or C-suite executive (as individually verified by our team), compared with approximately 9 percent for climate tech overall. As a next step, we also plan to examine the founder gender composition of all historic applicants, to review our sourcing efforts over time, and to track if and where representation slips during the diligence process.

Collect useful data, analyze it thoroughly, use it to enhance selection processes and program offerings, and share it

While there is significant data pointing to the gender funding disparity despite the higher performance of diverse teams, the research is often fragmented and hard to compare globally.

We pride ourselves on our tracking and use of data collected from our 268 portfolio companies, but doing the work for this article has exposed a number of deficiencies; as mentioned earlier, “founder” is a squishy term and doesn’t always convey who has the most ownership or meaningful leadership responsibility at a startup. We need crisper delineations between “women-only” and “mixed-gender” founding teams. (Many of the data sources referenced in this article did not offer clarity on this question, making it harder to parse the full implications of the analysis). We need more and better information on nonbinary founders. We need to do a better job of tracking progression through technology readiness levels. And we need more granular, accurate information on which services and offerings founders of various identities use most and find most useful.

Importantly, we also need to improve the way we as an ecosystem collect, track, and compare data across geographies. We’re committed to helping consolidate more representative global data, surfacing region-specific insights, and listening to the experiences of founders operating in both the Global North and Global South.

Lastly, we need a systematic analysis of the economic losses — and the opportunity cost in terms of climate impact — resulting from the gender gap in climate tech.

Once we collectively correct our deficiencies with respect to data collection and analysis, we will be in a better position to take meaningful action — which could entail refinements to our selection process, service offerings, mentor network, or partner engagement efforts. Third Derivative is committed to sharing our findings, and we encourage our peers to do the same.

Mentorship is good. Sponsorship and amplification are better.

One of the most consistent themes we heard from the women founders in our network was clear: while mentorship and advice are valuable, it’s the connections and introductions that truly move the needle. As an accelerator, we recognize that opening doors to the right investors, partners, and collaborators can be game-changing.

Supporting our founders means going beyond guidance — we actively work to expand their networks and create access to meaningful opportunities. Here’s a snapshot of what that support looks like, in the words of the founders themselves:

It’s about the willingness to give introductions and not only support with advice. We were oversubscribed when trying to raise our pre-seed, largely thanks to investor intros from other female founders.

Leise Sandeman, Co-CEO and Co-Founder, Pathways

Most useful? Connections to the right type of advice; warm intros to investors, preferably at the senior level.

D3 Startup Founder, Anonymous

Real door-opening and building valuable connections is most useful.

Daphna Wiener, Chairperson, Criaterra Innovations

We support all our founders, but given the disparities we’ve highlighted, it is especially important to celebrate the female and nonbinary role models among them. As an ecosystem, we can collectively do this through storytelling in a range of media and by giving them the stage and an active voice at events and through our communications channels.

Pitch competitions and juries should actively promote female applicants, ensuring they are given visibility and a chance to shine on stage.

Charlotta Holmquist, Chairwoman and Co-Founder of BLIXT

This is supported by evidence pointing to how female role models in male-dominated fields can combat stereotypes and biases, foster greater inclusivity, and raise the confidence and aspirations of prospective female founders.

We’re looking for the flywheel effect. Telling the inspiring stories of our current female founders (or having them tell those stories themselves) leads to more female founders, which leads to more inspiring stories of female founders, which leads to more female founders…

Founder feedback is key

Responding to the question of what they find the least useful, our founders often cited repetitive, curriculum-based, cookie-cutter programs and classes, such as “pitching 101,” or accelerator coaching from mentors who lack the relevant skills or networks.

We actively try to avoid generic programming through a light-touch, fully remote 18-month program designed to meet founders where they are. This begins with a needs assessment, led by a dedicated account manager, to identify the right forms of support. We try to stay current with and responsive to changing needs through regular check-in calls and quarterly surveys. Founders have access to RMI experts with a range of geographic, sector, and functional specializations, as well as a mentor network of 200+ entrepreneurs, corporate executives, innovation leaders, technology experts, and policy wonks. Virtual and in-person events include recurring dialogues with peers, corporate leaders, and investors, with topics sourced from our founders and partners.

Most importantly, there is a heavy emphasis on capital mobilization, corporate partnerships, and progress toward commercialization. We support our founders with their entire fundraising process, including preparation, introductions, and negotiation advice. In the past year alone, we’ve brokered around 950 connections between our startups and our investor and corporate partners.

A call to action for the climate tech ecosystem

A more inclusive and equitable climate tech venture ecosystem isn’t just an ideal — it’s a necessity. When every fraction of a degree and every year matters, a 10 percent faster exit and $12 billion more flowing back to early-stage investors would be transformative — reshaping the landscape of progress and possibility.

At a moment when “diversity” and “meritocracy” are being framed as opposing forces, the data are telling us a different story. When underrepresentation is the result of bias, correcting that bias is not a concession — it is a necessary condition for meritocracy. It is simply good business.

While researching and writing this piece, we asked ourselves how we can move from recommendations to concrete actions. We have identified two sets of steps: one we can take internally, and one where we need partnership (and funding) to achieve meaningful impact.

D3’s internal steps: In addition to our existing efforts and initiatives that support our women founders, we plan to leverage D3’s existing resources to:

- Design and execute a focused strategy to increase women-led startup applications, taking advantage of the breadth and diversity of our network to reach and encourage them;

- Analyze historic applicant data to assess founder gender representation and identify drop-offs during sourcing and diligence to help further debias our selection process; and

- Continue developing the women on our team into leaders and future principals.

Steps unlocked via partnership: We want to look beyond our internal capabilities and existing funding to find partners who can help us:

- Collect better data and conduct more robust analysis on women founders in climate tech to improve accuracy and inform smarter funding decisions;

- Design and implement more responsive support and programming for our women founders;

- Create a geographically diverse database of support initiatives for women in climate tech;

- Partner with and refer our founders to other programs with services designed for women founders; and

- Highlight and elevate promising women-founded startups in our communications and events.

Whether you’re an investor looking to support high-potential women-led ventures, an industry expert willing to share your knowledge, or part of an organization working to dismantle gender disparities in climate tech, we welcome your collaboration.

Reach out to us at info@third-derivative.org — we’d love to hear from you.

Further resources and reading

- Closing the Gender Gap in the Climate Change Space (2023)

- Pitchbook European and US female founder dashboards (2025)

- PwC insights into women founders in climate tech based (2025)

- Greenbiz summary of VC funding for female founders (2024)

- Techcrunch summary of VC funding for female founders (2023)

- Harvard Kennedy School study on advancing gender equality in VC (2019)

- BCG and MassChallenge study on gender and startup performance (2018)

- BCG study on the benefits of diverse leadership teams (2018)

- UK government’s omen-led high-growth enterprise taskforce report (2023)

- First Round Capital’s summary of female founders’ superior performance in their own portfolio (2020)

- Forbes article summarising the BCG and First Round Capital highlighted above (2020)

- UNFCCC Gender Climate Action Plan

- Gaps and Silences: Gender and Climate Policies in the Global North (2023)

A special thank you to the Third Derivative founders, partners, and diverse group of ecosystem stakeholders who generously contributed their input for this piece through interviews and surveys, and to Alla Ouvarova and Mary Hunter for co-hosting our roundtable on this topic at London Climate Action Week 2024.

The disruptive impact of climate change demands bold innovation — and equally bold, strategic investment. One proven way to unlock stronger returns and accelerate solutions? Fund more women-led startups in climate tech. The data supporting their success is clear and growing — but the capital still isn’t flowing at the scale it should be. This gap means that money and climate impact are being left on the table.

Female founders could be ‘moneyball’ for climate tech.

In this article, we aim to shed light on:

- How much more money could be made if we successfully address gender disparities in climate tech.

- The disconnect between the proven potential of women-led climate tech teams and the persistently low investment levels they receive — and the reasons for this persistent gap.

- What we’ve gotten right at Third Derivative and, more importantly, how we need to improve — grounded in direct feedback from several of the women leading our portfolio companies.

Globally, female-only founders in climate tech captured just 5.3 percent of climate tech deals and 1.1 percent of total funding in the first nine months of 2024. Mixed-gender founding teams accounted for 21 percent of deals and 7 percent of capital raised. Similarly, in the United States, exclusively female-founded companies received just $136 million — only 0.4 percent of the $34 billion invested in climate tech startups — while mixed-gender founding teams secured $2.5 billion, or roughly 7.3 percent of total funding. This means that globally and in the United States, nearly over 90 percent of investment went to founding teams composed entirely of men.

These 2024 numbers are more skewed than the breakdown for venture capital (VC) investment across all sectors, with approximately 21 percent of VC dollars going to mixed-gender founding teams, 77 percent going to all-men founding teams, and 2 percent going to all-women founding teams in the United States.

However, this article isn’t about ethics, it’s about economics.

A $12 billion market opportunity

This gender disparity in climate tech leaves a lot of money on the table. Consistently investing in mixed-gender founding climate tech teams would create over $12 billion in additional annual returns.

This is based on a few assumptions and historical data. One, it assumes that the gender difference in VC investment performance found in 2018 persists today. Two, it assumes that the gender performance difference for VC in general applies to climate tech in particular. And three, it assumes average performance based on historical data and funding (internal rate of return [IRR] of ~19 percent from 2005 to 2021).

Even offering these disclaimers is a bit ironic, since women founders are generally better at offering disclaimers and avoiding the oversell — unfortunately to their detriment (more on this below).

Importantly, there is little evidence to suggest that the gap in investment performance has narrowed or that it differs significantly between climate tech and the broader VC investment landscape.

Male-only teams account for 90 percent of VC funding globally. Closing this gap in climate tech VC investing could deliver an additional $12 billion in annual returns. While $12 billion is good money, the climate impact is even better. Closing the gap would mean that critical early-stage solutions make faster progress to commercialization, eliminating more climate pollution, sooner. Assuming exits are a reasonable proxy for commercialization, that means a 13 percent reduction in the average time it takes to go from early prototype (technology readiness level 4) to commercial operation (technology readiness level 9).

What the data says: Gender diversity is good business

We invest in female founders because they consistently outperform — delivering higher returns, stronger capital efficiency, and deeper community impact. In Africa’s climate sector, women are not just underrepresented — they are underestimated. Backing them is not charity; it’s smart investing.

Lyndsay Holley Handler, Managing Partner of Delta40 and former CEO of Fenix International

Our $12 billion conclusion is based on a rich body of evidence. A 2018 study from consulting firm BCG and MassChallenge (a network of accelerators) found that startups with female founders — including startups with mixed-gender founding teams — returned $0.78 in revenue for every dollar invested compared with $0.31 for startups with men-only founding teams. (Granted, revenue is not the same as returns, and different industries and products have different unit economics, but the study included a wide range of businesses and locations.)

Startups with at least one woman founder also deliver faster exits — 7.2 years versus the US average of 8.1 years. It’s worth noting that the latter figure includes women — which means that the performance difference is even bigger when comparing mixed-gender founding teams against men-only founding teams.

These advantages persist as companies mature. A 2017 survey of more than 1,000 mature companies across 12 countries found a strong correlation between executive gender diversity and financial performance; companies that were in the top quartile for gender diversity were 21 percent more likely to have above-median financial performance than companies in the lowest quartile for gender diversity.

None of this is new, considering the wealth of gender-related data already available on academic and workplace performance and strengths. That women-led startups do better is consistent with the data showing that females outperform males in academic success (across nearly all subjects and education levels, including enrollment and graduation rates), emotional intelligence, and leadership characteristics.

And still, even with the growing amount of publicly available evidence and references to women founder performance, the gap in climate tech persists.

It’s a no-brainer to boost support of women-led startups in climate and energy tech — 2050 is just around the corner. Women bring a different approach to risk and an understanding of context, which will open new avenues.

Capella Festa, President of Schlumberger Foundation

From insight to action — what’s missing?

With years of documented evidence showing the strong performance of women-led and gender-diverse teams, it’s natural to ask: why hasn’t this translated into more equitable investment? It’s a question we’ve been reflecting on ourselves.

Part of the answer lies in the deep-rooted norms and long-standing decision-making patterns that still shape much of the investment community. These habits are often reinforced by networks that remain relatively homogenous, informal deal flow processes that rely heavily on personal connections, and a tendency to default to “pattern recognition” that favors familiar profiles — usually male.

Both women and men may genuinely want to support female founders, but unconsciously, many of us are conditioned to perceive men as more natural “doers” or executors. As a result, I often find myself being tested by both women and men alike.

Aurélie Gonzalez, Founder and CEO of Yama

When it comes to the composition of venture capital firm teams, these dynamics also apply. Women make up only 19 percent of investing partners at VC firms in the United States, despite making up approximately 50 percent of the student body at top US business schools. Research shows that when VC firms increase their female partner hires by 10 percent, they see a 1.5 percent increase in annual fund returns and 10 percent more profitable exits.

And yet, even this kind of compelling data — like the stronger financial performance of diverse teams across startups and venture capital firms — can be ignored when it challenges ingrained instincts.

The data may also not be reaching the right people — or it may not be packaged in a way that resonates. Investment professionals are inundated with information, and unless insights are directly tied to their day-to-day decision-making, portfolio goals, or return metrics, they can easily be dismissed as peripheral or “nice to have.” Data that speaks to diversity without clearly demonstrating the associated economic opportunity may struggle to gain traction in traditional investment environments. Similarly, insights that aren’t broken down by sector, geography, or stage may be seen as too general to inform real decisions.

Relatedly, the data may lack the consistency or clarity needed to drive conviction at scale. How we collectively define terms like “founder” or “women-led” or even “climate tech” matters more than we often realize. These definitions shape who gets counted in the data. A narrow or inconsistent definition can exclude key contributors — such as co-founders who may not hold a C-level title.

On the other hand, when definitions are too broad or inconsistently applied, we risk overrepresenting progress in the data and painting a misleading picture of inclusion. It may suggest that the investment landscape is more equitable than it actually is, discouraging the very action and urgency needed to drive change. When data skews toward inclusion without precision, it can weaken the case for targeted support, dilute the impact of real progress, and make it harder to identify and address persistent structural barriers. For example, platforms like Pitchbook, Dealroom, and Crunchbase — commonly used as primary data sources in studies and publications on women founders — often report differing figures.

Another caveat is that most available data on founder diversity centers on deal counts and funding amounts, while comprehensive statistics on the total number of climate tech startups —and how many are led by women — are much harder to find.

An added shortcoming that we must recognize with available data: much of it is centered on the Global North. The majority of available research, metrics, and case studies are drawn from North America and Europe, where data is more readily collected and shared — but this paints an incomplete picture of the global innovation landscape.

Lastly, it’s hard to ignore the macro environment in which climate tech founders operate today. According to PitchBook, over the past two years, the majority of the largest US public alternative asset managers have removed diversity, equity, and inclusion (DEI) language and initiatives. Decisions like these, along with government actions aimed at curbing DEI, have a direct effect. This will likely further impact VC initiatives to increase investment in women climate tech founders, effectively narrowing entry points for underrepresented founders.

We at Third Derivative realize that simply surfacing data isn’t enough. Changing behavior requires not just awareness, but also trust, relevance, and actionable pathways. This realization is shaping how we approach our work — by not only sharing compelling evidence, but also tailoring insights for the audiences we’re trying to influence, listening to the feedback of founders directly, and being honest about where we, too, need to learn and evolve.

Working together to shift the system

A number of organizations have developed comprehensive sets of recommendations aimed at addressing gender disparities in venture capital writ large, including Harvard, Diversity VC, 2X Challenge, UBS, BCG, MassChallenge, and the World Economic Forum. Rather than attempt to recreate or synthesize them, we focus here on a subset of actions over which Third Derivative, RMI, and our ecosystem have the most agency.

Third Derivative is a global climate tech accelerator, research organization, and nonprofit investor, not a VC firm. Nevertheless, we hope some of these ideas — many sourced directly from our founders — are useful to both climate tech VCs and others in the space — venture studios, accelerators, professional services firms serving climate tech founders, and later-stage investors.

Most importantly, all actions highlighted below come from the same starting point: an honest accounting of where the sector is today and a willingness for ecosystem players to do something about it — even if that willingness is simply rooted in making more money. (As goes an RMI mantra: we care about outcomes, not motives.)

Attendees at Third Derivative’s co-hosted breakfast roundtable, Investing in Climate Tech: Spotlighting Female Innovators, at London Climate Action Week 2024. For each of the recommendations below, we’ve analyzed where Third Derivative has identified effective approaches we can confidently recommend to others; where we are actively developing new systems that show promise but are still evolving; and where we look for ideas, insights, and collaboration from our broader ecosystem.

Ensure gender balance on teams, paying particularly close attention to leadership, investment, and diligence functions

In many ways, Third Derivative is making meaningful progress toward the kind of team representation we want to see. Currently, 58 percent of our team identifies as female, with an additional 6 percent identifying as “unspecified.” Among those in leadership and management roles (principals and managers), that figure rises to 69 percent. However, when focusing solely on principal-level leadership, the gender balance shifts — four of six principals currently identify as male. As our managers continue to grow into senior roles, we’re committed to helping more women managers grow into principal roles.

We are working to ensure that opportunities for career development and progression are equally available to our early-career people, including through structured mentorship and coaching, individual development plans, and a transparent performance review process.

Organizations such as Diversity VC offer useful lessons in this. Their mission is “to equip every venture fund to have the understanding, tools, and resources to promote diversity and inclusion in both their firms and the companies they fund.” They have a wide array of publicly available resources, including a Diversity in VC Toolkit. We also look to connect and learn more from other VCs and accelerators that place high value on team diversity, such as Delta40, Lowercarbon Capital, the Los Angeles Cleantech Incubator (LACI), Powerhouse Ventures, Rethink Impact, and VentureSouq.

Building balanced teams is essential, but it’s equally important to recognize the pivotal role male allies play in advancing equity and driving meaningful change. A survey by All Raise of women and nonbinary individuals in venture capital found that 98 percent received critical support from men — whether through championing them for promotions, co-investing, or facilitating key introductions.

At Third Derivative, we believe that advocating for women founders and building a more inclusive ecosystem isn’t just the work of our female and nonbinary-identifying team members — it’s a shared responsibility across the entire team. All team members, regardless of gender, are encouraged — and expected — to actively contribute to this effort. That includes speaking up when they witness bias or discrimination, and using their platforms to elevate and support women and nonbinary team members and founders.

Ascribe value for gender diversity, maximize objectivity, and minimize bias in selection and diligence processes

Third Derivative attempts to minimize bias through a rigorous three-part selection process that strives for objectivity. Crucially, we try to ensure gender diversity in our own evaluation teams and try to stay aware of and eliminate affinity and other biases.

The process begins with an active sourcing push, led by our research and diligence (R&D) team, where diverse teams are encouraged to apply. This is complemented by an open call for applications. Admittedly, there is still room for us to improve by taking more strategic and concerted efforts to recruit women-led startup applicants — something we commit to designing and executing as part of our upcoming fiscal year strategy, calling upon our ecosystem for support.

Applicant evaluations are conducted using a standardized methodology to quantify climate change mitigation potential, complemented by qualitative assessments of impacts on Earth system boundaries, climate adaptation, environmental justice, and public health. Individual assessments by the R&D team are followed by group discussions to minimize bias from seniority or influence. Insights are also drawn from RMI’s extensive expert network and a broad range of industry and academic partners to enhance objectivity and diversity. In the final stage, selected founders present to our corporate and investor partners in structured pitch sessions, with partner feedback helping inform the final, collaboratively debated selection. The final selection committee and broader debate group are gender diverse. While it’s not feasible for all applicants, we also strive to offer actionable feedback to those reaching the final stage.

The result is that the Third Derivative portfolio, while still having areas to improve, looks better than average; 34 percent of our portfolio companies have at least one female founder or C-suite executive (as individually verified by our team), compared with approximately 9 percent for climate tech overall. As a next step, we also plan to examine the founder gender composition of all historic applicants, to review our sourcing efforts over time, and to track if and where representation slips during the diligence process.

Collect useful data, analyze it thoroughly, use it to enhance selection processes and program offerings, and share it

While there is significant data pointing to the gender funding disparity despite the higher performance of diverse teams, the research is often fragmented and hard to compare globally.

We pride ourselves on our tracking and use of data collected from our 268 portfolio companies, but doing the work for this article has exposed a number of deficiencies; as mentioned earlier, “founder” is a squishy term and doesn’t always convey who has the most ownership or meaningful leadership responsibility at a startup. We need crisper delineations between “women-only” and “mixed-gender” founding teams. (Many of the data sources referenced in this article did not offer clarity on this question, making it harder to parse the full implications of the analysis). We need more and better information on nonbinary founders. We need to do a better job of tracking progression through technology readiness levels. And we need more granular, accurate information on which services and offerings founders of various identities use most and find most useful.

Importantly, we also need to improve the way we as an ecosystem collect, track, and compare data across geographies. We’re committed to helping consolidate more representative global data, surfacing region-specific insights, and listening to the experiences of founders operating in both the Global North and Global South.

Lastly, we need a systematic analysis of the economic losses — and the opportunity cost in terms of climate impact — resulting from the gender gap in climate tech.

Once we collectively correct our deficiencies with respect to data collection and analysis, we will be in a better position to take meaningful action — which could entail refinements to our selection process, service offerings, mentor network, or partner engagement efforts. Third Derivative is committed to sharing our findings, and we encourage our peers to do the same.

Mentorship is good. Sponsorship and amplification are better.

One of the most consistent themes we heard from the women founders in our network was clear: while mentorship and advice are valuable, it’s the connections and introductions that truly move the needle. As an accelerator, we recognize that opening doors to the right investors, partners, and collaborators can be game-changing.

Supporting our founders means going beyond guidance — we actively work to expand their networks and create access to meaningful opportunities. Here’s a snapshot of what that support looks like, in the words of the founders themselves:

It’s about the willingness to give introductions and not only support with advice. We were oversubscribed when trying to raise our pre-seed, largely thanks to investor intros from other female founders.

Leise Sandeman, Co-CEO and Co-Founder, Pathways

Most useful? Connections to the right type of advice; warm intros to investors, preferably at the senior level.

D3 Startup Founder, Anonymous

Real door-opening and building valuable connections is most useful.

Daphna Wiener, Chairperson, Criaterra Innovations

We support all our founders, but given the disparities we’ve highlighted, it is especially important to celebrate the female and nonbinary role models among them. As an ecosystem, we can collectively do this through storytelling in a range of media and by giving them the stage and an active voice at events and through our communications channels.

Pitch competitions and juries should actively promote female applicants, ensuring they are given visibility and a chance to shine on stage.

Charlotta Holmquist, Chairwoman and Co-Founder of BLIXT

This is supported by evidence pointing to how female role models in male-dominated fields can combat stereotypes and biases, foster greater inclusivity, and raise the confidence and aspirations of prospective female founders.

We’re looking for the flywheel effect. Telling the inspiring stories of our current female founders (or having them tell those stories themselves) leads to more female founders, which leads to more inspiring stories of female founders, which leads to more female founders…

Founder feedback is key

Responding to the question of what they find the least useful, our founders often cited repetitive, curriculum-based, cookie-cutter programs and classes, such as “pitching 101,” or accelerator coaching from mentors who lack the relevant skills or networks.

We actively try to avoid generic programming through a light-touch, fully remote 18-month program designed to meet founders where they are. This begins with a needs assessment, led by a dedicated account manager, to identify the right forms of support. We try to stay current with and responsive to changing needs through regular check-in calls and quarterly surveys. Founders have access to RMI experts with a range of geographic, sector, and functional specializations, as well as a mentor network of 200+ entrepreneurs, corporate executives, innovation leaders, technology experts, and policy wonks. Virtual and in-person events include recurring dialogues with peers, corporate leaders, and investors, with topics sourced from our founders and partners.

Most importantly, there is a heavy emphasis on capital mobilization, corporate partnerships, and progress toward commercialization. We support our founders with their entire fundraising process, including preparation, introductions, and negotiation advice. In the past year alone, we’ve brokered around 950 connections between our startups and our investor and corporate partners.

A call to action for the climate tech ecosystem

A more inclusive and equitable climate tech venture ecosystem isn’t just an ideal — it’s a necessity. When every fraction of a degree and every year matters, a 10 percent faster exit and $12 billion more flowing back to early-stage investors would be transformative — reshaping the landscape of progress and possibility.

At a moment when “diversity” and “meritocracy” are being framed as opposing forces, the data are telling us a different story. When underrepresentation is the result of bias, correcting that bias is not a concession — it is a necessary condition for meritocracy. It is simply good business.

While researching and writing this piece, we asked ourselves how we can move from recommendations to concrete actions. We have identified two sets of steps: one we can take internally, and one where we need partnership (and funding) to achieve meaningful impact.

D3’s internal steps: In addition to our existing efforts and initiatives that support our women founders, we plan to leverage D3’s existing resources to:

- Design and execute a focused strategy to increase women-led startup applications, taking advantage of the breadth and diversity of our network to reach and encourage them;

- Analyze historic applicant data to assess founder gender representation and identify drop-offs during sourcing and diligence to help further debias our selection process; and

- Continue developing the women on our team into leaders and future principals.

Steps unlocked via partnership: We want to look beyond our internal capabilities and existing funding to find partners who can help us:

- Collect better data and conduct more robust analysis on women founders in climate tech to improve accuracy and inform smarter funding decisions;

- Design and implement more responsive support and programming for our women founders;

- Create a geographically diverse database of support initiatives for women in climate tech;

- Partner with and refer our founders to other programs with services designed for women founders; and

- Highlight and elevate promising women-founded startups in our communications and events.

Whether you’re an investor looking to support high-potential women-led ventures, an industry expert willing to share your knowledge, or part of an organization working to dismantle gender disparities in climate tech, we welcome your collaboration.

Reach out to us at info@third-derivative.org — we’d love to hear from you.

Further resources and reading

- Closing the Gender Gap in the Climate Change Space (2023)

- Pitchbook European and US female founder dashboards (2025)

- PwC insights into women founders in climate tech based (2025)

- Greenbiz summary of VC funding for female founders (2024)

- Techcrunch summary of VC funding for female founders (2023)

- Harvard Kennedy School study on advancing gender equality in VC (2019)

- BCG and MassChallenge study on gender and startup performance (2018)

- BCG study on the benefits of diverse leadership teams (2018)

- UK government’s omen-led high-growth enterprise taskforce report (2023)

- First Round Capital’s summary of female founders’ superior performance in their own portfolio (2020)

- Forbes article summarising the BCG and First Round Capital highlighted above (2020)

- UNFCCC Gender Climate Action Plan

- Gaps and Silences: Gender and Climate Policies in the Global North (2023)

A special thank you to the Third Derivative founders, partners, and diverse group of ecosystem stakeholders who generously contributed their input for this piece through interviews and surveys, and to Alla Ouvarova and Mary Hunter for co-hosting our roundtable on this topic at London Climate Action Week 2024.

This gender disparity in climate tech leaves a lot of money on the table. Consistently investing in mixed-gender founding climate tech teams would create over $12 billion in additional annual returns.

This is based on a few assumptions and historical data. One, it assumes that the gender difference in VC investment performance found in 2018 persists today. Two, it assumes that the gender performance difference for VC in general applies to climate tech in particular. And three, it assumes average performance based on historical data and funding (internal rate of return [IRR] of ~19 percent from 2005 to 2021).

Even offering these disclaimers is a bit ironic, since women founders are generally better at offering disclaimers and avoiding the oversell — unfortunately to their detriment (more on this below).

Importantly, there is little evidence to suggest that the gap in investment performance has narrowed or that it differs significantly between climate tech and the broader VC investment landscape.

Male-only teams account for 90 percent of VC funding globally. Closing this gap in climate tech VC investing could deliver an additional $12 billion in annual returns. While $12 billion is good money, the climate impact is even better. Closing the gap would mean that critical early-stage solutions make faster progress to commercialization, eliminating more climate pollution, sooner. Assuming exits are a reasonable proxy for commercialization, that means a 13 percent reduction in the average time it takes to go from early prototype (technology readiness level 4) to commercial operation (technology readiness level 9).

We invest in female founders because they consistently outperform — delivering higher returns, stronger capital efficiency, and deeper community impact. In Africa’s climate sector, women are not just underrepresented — they are underestimated. Backing them is not charity; it’s smart investing.

Our $12 billion conclusion is based on a rich body of evidence. A 2018 study from consulting firm BCG and MassChallenge (a network of accelerators) found that startups with female founders — including startups with mixed-gender founding teams — returned $0.78 in revenue for every dollar invested compared with $0.31 for startups with men-only founding teams. (Granted, revenue is not the same as returns, and different industries and products have different unit economics, but the study included a wide range of businesses and locations.)

Startups with at least one woman founder also deliver faster exits — 7.2 years versus the US average of 8.1 years. It’s worth noting that the latter figure includes women — which means that the performance difference is even bigger when comparing mixed-gender founding teams against men-only founding teams.

These advantages persist as companies mature. A 2017 survey of more than 1,000 mature companies across 12 countries found a strong correlation between executive gender diversity and financial performance; companies that were in the top quartile for gender diversity were 21 percent more likely to have above-median financial performance than companies in the lowest quartile for gender diversity.

None of this is new, considering the wealth of gender-related data already available on academic and workplace performance and strengths. That women-led startups do better is consistent with the data showing that females outperform males in academic success (across nearly all subjects and education levels, including enrollment and graduation rates), emotional intelligence, and leadership characteristics.

And still, even with the growing amount of publicly available evidence and references to women founder performance, the gap in climate tech persists.

It’s a no-brainer to boost support of women-led startups in climate and energy tech — 2050 is just around the corner. Women bring a different approach to risk and an understanding of context, which will open new avenues.

From insight to action — what’s missing?

With years of documented evidence showing the strong performance of women-led and gender-diverse teams, it’s natural to ask: why hasn’t this translated into more equitable investment? It’s a question we’ve been reflecting on ourselves.

Part of the answer lies in the deep-rooted norms and long-standing decision-making patterns that still shape much of the investment community. These habits are often reinforced by networks that remain relatively homogenous, informal deal flow processes that rely heavily on personal connections, and a tendency to default to “pattern recognition” that favors familiar profiles — usually male.

Both women and men may genuinely want to support female founders, but unconsciously, many of us are conditioned to perceive men as more natural “doers” or executors. As a result, I often find myself being tested by both women and men alike.

Aurélie Gonzalez, Founder and CEO of Yama

When it comes to the composition of venture capital firm teams, these dynamics also apply. Women make up only 19 percent of investing partners at VC firms in the United States, despite making up approximately 50 percent of the student body at top US business schools. Research shows that when VC firms increase their female partner hires by 10 percent, they see a 1.5 percent increase in annual fund returns and 10 percent more profitable exits.

And yet, even this kind of compelling data — like the stronger financial performance of diverse teams across startups and venture capital firms — can be ignored when it challenges ingrained instincts.

The data may also not be reaching the right people — or it may not be packaged in a way that resonates. Investment professionals are inundated with information, and unless insights are directly tied to their day-to-day decision-making, portfolio goals, or return metrics, they can easily be dismissed as peripheral or “nice to have.” Data that speaks to diversity without clearly demonstrating the associated economic opportunity may struggle to gain traction in traditional investment environments. Similarly, insights that aren’t broken down by sector, geography, or stage may be seen as too general to inform real decisions.

Relatedly, the data may lack the consistency or clarity needed to drive conviction at scale. How we collectively define terms like “founder” or “women-led” or even “climate tech” matters more than we often realize. These definitions shape who gets counted in the data. A narrow or inconsistent definition can exclude key contributors — such as co-founders who may not hold a C-level title.

On the other hand, when definitions are too broad or inconsistently applied, we risk overrepresenting progress in the data and painting a misleading picture of inclusion. It may suggest that the investment landscape is more equitable than it actually is, discouraging the very action and urgency needed to drive change. When data skews toward inclusion without precision, it can weaken the case for targeted support, dilute the impact of real progress, and make it harder to identify and address persistent structural barriers. For example, platforms like Pitchbook, Dealroom, and Crunchbase — commonly used as primary data sources in studies and publications on women founders — often report differing figures.

Another caveat is that most available data on founder diversity centers on deal counts and funding amounts, while comprehensive statistics on the total number of climate tech startups —and how many are led by women — are much harder to find.

An added shortcoming that we must recognize with available data: much of it is centered on the Global North. The majority of available research, metrics, and case studies are drawn from North America and Europe, where data is more readily collected and shared — but this paints an incomplete picture of the global innovation landscape.

Lastly, it’s hard to ignore the macro environment in which climate tech founders operate today. According to PitchBook, over the past two years, the majority of the largest US public alternative asset managers have removed diversity, equity, and inclusion (DEI) language and initiatives. Decisions like these, along with government actions aimed at curbing DEI, have a direct effect. This will likely further impact VC initiatives to increase investment in women climate tech founders, effectively narrowing entry points for underrepresented founders.

We at Third Derivative realize that simply surfacing data isn’t enough. Changing behavior requires not just awareness, but also trust, relevance, and actionable pathways. This realization is shaping how we approach our work — by not only sharing compelling evidence, but also tailoring insights for the audiences we’re trying to influence, listening to the feedback of founders directly, and being honest about where we, too, need to learn and evolve.

Working together to shift the system

A number of organizations have developed comprehensive sets of recommendations aimed at addressing gender disparities in venture capital writ large, including Harvard, Diversity VC, 2X Challenge, UBS, BCG, MassChallenge, and the World Economic Forum. Rather than attempt to recreate or synthesize them, we focus here on a subset of actions over which Third Derivative, RMI, and our ecosystem have the most agency.

Third Derivative is a global climate tech accelerator, research organization, and nonprofit investor, not a VC firm. Nevertheless, we hope some of these ideas — many sourced directly from our founders — are useful to both climate tech VCs and others in the space — venture studios, accelerators, professional services firms serving climate tech founders, and later-stage investors.

Most importantly, all actions highlighted below come from the same starting point: an honest accounting of where the sector is today and a willingness for ecosystem players to do something about it — even if that willingness is simply rooted in making more money. (As goes an RMI mantra: we care about outcomes, not motives.)

Attendees at Third Derivative’s co-hosted breakfast roundtable, Investing in Climate Tech: Spotlighting Female Innovators, at London Climate Action Week 2024. For each of the recommendations below, we’ve analyzed where Third Derivative has identified effective approaches we can confidently recommend to others; where we are actively developing new systems that show promise but are still evolving; and where we look for ideas, insights, and collaboration from our broader ecosystem.

Ensure gender balance on teams, paying particularly close attention to leadership, investment, and diligence functions

In many ways, Third Derivative is making meaningful progress toward the kind of team representation we want to see. Currently, 58 percent of our team identifies as female, with an additional 6 percent identifying as “unspecified.” Among those in leadership and management roles (principals and managers), that figure rises to 69 percent. However, when focusing solely on principal-level leadership, the gender balance shifts — four of six principals currently identify as male. As our managers continue to grow into senior roles, we’re committed to helping more women managers grow into principal roles.

We are working to ensure that opportunities for career development and progression are equally available to our early-career people, including through structured mentorship and coaching, individual development plans, and a transparent performance review process.

Organizations such as Diversity VC offer useful lessons in this. Their mission is “to equip every venture fund to have the understanding, tools, and resources to promote diversity and inclusion in both their firms and the companies they fund.” They have a wide array of publicly available resources, including a Diversity in VC Toolkit. We also look to connect and learn more from other VCs and accelerators that place high value on team diversity, such as Delta40, Lowercarbon Capital, the Los Angeles Cleantech Incubator (LACI), Powerhouse Ventures, Rethink Impact, and VentureSouq.

Building balanced teams is essential, but it’s equally important to recognize the pivotal role male allies play in advancing equity and driving meaningful change. A survey by All Raise of women and nonbinary individuals in venture capital found that 98 percent received critical support from men — whether through championing them for promotions, co-investing, or facilitating key introductions.

At Third Derivative, we believe that advocating for women founders and building a more inclusive ecosystem isn’t just the work of our female and nonbinary-identifying team members — it’s a shared responsibility across the entire team. All team members, regardless of gender, are encouraged — and expected — to actively contribute to this effort. That includes speaking up when they witness bias or discrimination, and using their platforms to elevate and support women and nonbinary team members and founders.

Ascribe value for gender diversity, maximize objectivity, and minimize bias in selection and diligence processes

Third Derivative attempts to minimize bias through a rigorous three-part selection process that strives for objectivity. Crucially, we try to ensure gender diversity in our own evaluation teams and try to stay aware of and eliminate affinity and other biases.

The process begins with an active sourcing push, led by our research and diligence (R&D) team, where diverse teams are encouraged to apply. This is complemented by an open call for applications. Admittedly, there is still room for us to improve by taking more strategic and concerted efforts to recruit women-led startup applicants — something we commit to designing and executing as part of our upcoming fiscal year strategy, calling upon our ecosystem for support.

Applicant evaluations are conducted using a standardized methodology to quantify climate change mitigation potential, complemented by qualitative assessments of impacts on Earth system boundaries, climate adaptation, environmental justice, and public health. Individual assessments by the R&D team are followed by group discussions to minimize bias from seniority or influence. Insights are also drawn from RMI’s extensive expert network and a broad range of industry and academic partners to enhance objectivity and diversity. In the final stage, selected founders present to our corporate and investor partners in structured pitch sessions, with partner feedback helping inform the final, collaboratively debated selection. The final selection committee and broader debate group are gender diverse. While it’s not feasible for all applicants, we also strive to offer actionable feedback to those reaching the final stage.

The result is that the Third Derivative portfolio, while still having areas to improve, looks better than average; 34 percent of our portfolio companies have at least one female founder or C-suite executive (as individually verified by our team), compared with approximately 9 percent for climate tech overall. As a next step, we also plan to examine the founder gender composition of all historic applicants, to review our sourcing efforts over time, and to track if and where representation slips during the diligence process.

Collect useful data, analyze it thoroughly, use it to enhance selection processes and program offerings, and share it

While there is significant data pointing to the gender funding disparity despite the higher performance of diverse teams, the research is often fragmented and hard to compare globally.

We pride ourselves on our tracking and use of data collected from our 268 portfolio companies, but doing the work for this article has exposed a number of deficiencies; as mentioned earlier, “founder” is a squishy term and doesn’t always convey who has the most ownership or meaningful leadership responsibility at a startup. We need crisper delineations between “women-only” and “mixed-gender” founding teams. (Many of the data sources referenced in this article did not offer clarity on this question, making it harder to parse the full implications of the analysis). We need more and better information on nonbinary founders. We need to do a better job of tracking progression through technology readiness levels. And we need more granular, accurate information on which services and offerings founders of various identities use most and find most useful.

Importantly, we also need to improve the way we as an ecosystem collect, track, and compare data across geographies. We’re committed to helping consolidate more representative global data, surfacing region-specific insights, and listening to the experiences of founders operating in both the Global North and Global South.

Lastly, we need a systematic analysis of the economic losses — and the opportunity cost in terms of climate impact — resulting from the gender gap in climate tech.

Once we collectively correct our deficiencies with respect to data collection and analysis, we will be in a better position to take meaningful action — which could entail refinements to our selection process, service offerings, mentor network, or partner engagement efforts. Third Derivative is committed to sharing our findings, and we encourage our peers to do the same.

Mentorship is good. Sponsorship and amplification are better.

One of the most consistent themes we heard from the women founders in our network was clear: while mentorship and advice are valuable, it’s the connections and introductions that truly move the needle. As an accelerator, we recognize that opening doors to the right investors, partners, and collaborators can be game-changing.

Supporting our founders means going beyond guidance — we actively work to expand their networks and create access to meaningful opportunities. Here’s a snapshot of what that support looks like, in the words of the founders themselves:

It’s about the willingness to give introductions and not only support with advice. We were oversubscribed when trying to raise our pre-seed, largely thanks to investor intros from other female founders.

Leise Sandeman, Co-CEO and Co-Founder, Pathways

Most useful? Connections to the right type of advice; warm intros to investors, preferably at the senior level.

D3 Startup Founder, Anonymous

Real door-opening and building valuable connections is most useful.

Daphna Wiener, Chairperson, Criaterra Innovations

We support all our founders, but given the disparities we’ve highlighted, it is especially important to celebrate the female and nonbinary role models among them. As an ecosystem, we can collectively do this through storytelling in a range of media and by giving them the stage and an active voice at events and through our communications channels.

Pitch competitions and juries should actively promote female applicants, ensuring they are given visibility and a chance to shine on stage.

Charlotta Holmquist, Chairwoman and Co-Founder of BLIXT

This is supported by evidence pointing to how female role models in male-dominated fields can combat stereotypes and biases, foster greater inclusivity, and raise the confidence and aspirations of prospective female founders.

We’re looking for the flywheel effect. Telling the inspiring stories of our current female founders (or having them tell those stories themselves) leads to more female founders, which leads to more inspiring stories of female founders, which leads to more female founders…

Founder feedback is key

Responding to the question of what they find the least useful, our founders often cited repetitive, curriculum-based, cookie-cutter programs and classes, such as “pitching 101,” or accelerator coaching from mentors who lack the relevant skills or networks.

We actively try to avoid generic programming through a light-touch, fully remote 18-month program designed to meet founders where they are. This begins with a needs assessment, led by a dedicated account manager, to identify the right forms of support. We try to stay current with and responsive to changing needs through regular check-in calls and quarterly surveys. Founders have access to RMI experts with a range of geographic, sector, and functional specializations, as well as a mentor network of 200+ entrepreneurs, corporate executives, innovation leaders, technology experts, and policy wonks. Virtual and in-person events include recurring dialogues with peers, corporate leaders, and investors, with topics sourced from our founders and partners.

Most importantly, there is a heavy emphasis on capital mobilization, corporate partnerships, and progress toward commercialization. We support our founders with their entire fundraising process, including preparation, introductions, and negotiation advice. In the past year alone, we’ve brokered around 950 connections between our startups and our investor and corporate partners.

A call to action for the climate tech ecosystem

A more inclusive and equitable climate tech venture ecosystem isn’t just an ideal — it’s a necessity. When every fraction of a degree and every year matters, a 10 percent faster exit and $12 billion more flowing back to early-stage investors would be transformative — reshaping the landscape of progress and possibility.

At a moment when “diversity” and “meritocracy” are being framed as opposing forces, the data are telling us a different story. When underrepresentation is the result of bias, correcting that bias is not a concession — it is a necessary condition for meritocracy. It is simply good business.

While researching and writing this piece, we asked ourselves how we can move from recommendations to concrete actions. We have identified two sets of steps: one we can take internally, and one where we need partnership (and funding) to achieve meaningful impact.

D3’s internal steps: In addition to our existing efforts and initiatives that support our women founders, we plan to leverage D3’s existing resources to:

- Design and execute a focused strategy to increase women-led startup applications, taking advantage of the breadth and diversity of our network to reach and encourage them;

- Analyze historic applicant data to assess founder gender representation and identify drop-offs during sourcing and diligence to help further debias our selection process; and

- Continue developing the women on our team into leaders and future principals.

Steps unlocked via partnership: We want to look beyond our internal capabilities and existing funding to find partners who can help us:

- Collect better data and conduct more robust analysis on women founders in climate tech to improve accuracy and inform smarter funding decisions;

- Design and implement more responsive support and programming for our women founders;

- Create a geographically diverse database of support initiatives for women in climate tech;

- Partner with and refer our founders to other programs with services designed for women founders; and

- Highlight and elevate promising women-founded startups in our communications and events.

Whether you’re an investor looking to support high-potential women-led ventures, an industry expert willing to share your knowledge, or part of an organization working to dismantle gender disparities in climate tech, we welcome your collaboration.

Reach out to us at info@third-derivative.org — we’d love to hear from you.

Further resources and reading

- Closing the Gender Gap in the Climate Change Space (2023)

- Pitchbook European and US female founder dashboards (2025)

- PwC insights into women founders in climate tech based (2025)

- Greenbiz summary of VC funding for female founders (2024)

- Techcrunch summary of VC funding for female founders (2023)

- Harvard Kennedy School study on advancing gender equality in VC (2019)